CEO of Flippa, Blake Hutchison, shares his insights into the latest website trends, where opportunities can be found, and how to zero-in on valuable assets that can help you quit your job…

Want to get an inside look into what Flippa has to offer?

Who better to share that with you than the CEO of Flippa, Blake Hutchison.

Today, Blake is going to share:

- The 2 new online assets you can now buy on Flippa (based on high demand)

- The amazing opportunity for Digital Agency owners (and how to maximize profit)

- The most sought-after web assets on Flippa in 2024

- Why investors are looking for boring online businesses

- The impacts of the recent Google updates on websites

- Where to start your search if you’re looking to buy a website between $100,000 to $10 million

- How to find the perfect website deal for your personal situation and so much more..

Whether you’re a novice, an expert, or somewhere in the middle, you’ll hear valuable insights in this interview, so click play or read the article below.

Matt Raad: Today, we’ll hear from Blake Hutchison about buying digital assets on Flippa in 2024. In particular, we’re going to look at where the opportunities are. These might be opportunities you’re missing out on because there are some exciting new options for buying websites on the Flippa platform.

So, we’ll take a look at the trends we’re seeing out there, what’s working and what’s not working. Also, where are some of the challenges, and what are the opportunities to come out of those challenges?

Blake Hutchinson is the CEO of Flippa and a regular guest on our Digital Investors Podcast. He regularly speaks to our community about buying and selling digital assets. So, Blake, thank you so much for coming along today.

Blake Hutchison: I’m excited to have this chat with you, Matt. The world moves very fast, doesn’t it?

Matt: It certainly does, and there’s a lot to unpack here today. Whether you’re a beginner, intermediate, or advanced, I think there’s something here for everyone today.

Exciting new online assets are being offered for sale on the Flippa platform

See how Flippa is expanding its product offering of online businesses for sale across social media, communications, emails and software!

Matt: Let’s start out with some of the big changes you’ve been implementing on Flippa. I’m really excited about some of the new digital assets we can now buy on Flippa. And I believe some people in our community will be particularly interested in these new assets.

Blake: Just for context, we’ve done site stores and apps for a long time, being:

- A Site is a blog or an online publisher,

- A Store is an app, typically iOS and Android.

We started evolving the assets you can buy on Flippa. A year or so ago, we started offering SaaS businesses, and that’s been a fast-growing category for us.

But a few weeks ago, Matt, we launched newsletters. And this week, we’ve just launched YouTube channels and social media assets.

We’re offering that because of buyer demand and intent. We’ve benefited from a good amount of search volume on the platform, and therefore, we can see what buyers want. Put simply, a buyer looking for an asset and not being served up the right asset isn’t good for anyone.

As a result, we’ve started to evolve and build the categories around what buyers want. And YouTube channels, for instance, are very much in demand as are newsletters. Next up, we’ll have agencies.

Matt: Awesome, Blake, that’s exactly what we wanted to hear.

Why Flippa will soon be offering you the ability to buy and sell Digital Agency businesses

Matt: You’re the biggest broker in the world, and are very data-driven. So I want to ask – why digital agencies? I know why we’re excited from our point of view, but I’m interested to hear from you. What did you see there?

Blake: As I mentioned, we watch the type of search data and we get a sense of what buyers are looking for. And so, we are seeing a great deal of demand right now for agencies of all sorts. These businesses are typically digital-orientated, creative, SEO, and media-buying agencies. They are service businesses with a good repeat client base.

I wouldn’t say it’s SaaS revenue as it’s not ‘recurring’, but it is a repeat client base. Those who are on long-term contracts and/or retainers for ‘month-on-month’ service offerings are highly sought after. The reason is that the revenue is quite predictable. The service offerings and propositions come with a great deal of specialisation.

You’re acquiring something highly sought after with a specialisation that you can rely on and continue to invest in.

And we’ve seen a good amount of demand for those. The question will be the valuations.

How Flippa will determine the value of a digital agency business

Matt: How are you valuing agencies?

Blake: We’ve looked at market comps and have got our hands on a bunch of data. We typically use Flippa’s own available market data to provide price guidance and valuation estimates.

Obviously, you can do that where you have the data. But when you don’t have the data, you have to get it elsewhere. So, what we’ve done is look at a large number set. We’ve queried a bunch of advisory businesses that we are aware of and that we can talk to.

From there, we’ve been able to come up with indicative valuations for what is good and what is less good:

- Good: if you can get up to 5-6x, that’s good.

- Less Good: is more like 1-2x.

The difference between 1-2x and 5-6x is really about the longevity and repeatability of the client base. So if you’ve got 500 clients who have been paying you a monthly retainer for the past two to three years, clearly, that’s going to command a premium because it’s very predictable. It’s not quite as predictable as SaaS, but still very predictable.

Whereas, if your agency is a couple of years old, you’ve got 10 clients, and they typically pay you for a service and then go elsewhere, those agencies are going to be less sought after and less valuable.

Long story short, we follow what the buyers do, check out industry market comps, and then provide some initial pricing guidance. Once buyers start to buy and we have some data, those pricing comps will become more accurate over time.

There are plenty of buyers out there waiting to buy digital agencies

Matt: I know we’re very Australian-based, but we’ve been teaching the digital agency strategy here at eBusiness Institute. So, whilst this is happening in America right now, they’re really good for the bigger buyers, so this will be an interesting marketplace for you.

I think they might even buy up five or six of these digital agencies over time. As you said, the ones with recurring revenues would become a very sought-after form of digital asset, even though it’s not the traditional type of asset that Flippa would sell.

Isn’t it interesting how it’s evolved? Even though this is a service business, it’s still a digital asset at the end of the day, and so it’s all part of the ecosystem.

Blake: That’s the important piece of why we’re doing it. We’re not about to suddenly sell bakeries or plumbing businesses, but the reality is an SEO creative and or paid media agency is very much inextricably connected to the ecosystem.

The types of buyers who are looking to purchase Digital Agency businesses

Matt: Will you still have brokers involved in doing a bit of pre-due diligence to confirm revenues, etc.? How will that work with this sort of business?

Blake: 100%. These assets will be under our brokerage offering, which we call a managed marketplace or a managed platform.

The reality is that we understand and respect the power of an individual who has expertise and capability and can act as a conduit between the two parties. And so, that’s no different with an agency. In fact, it’s probably more pertinent as a function of the value that the average agency will probably command on the platform and as a function of the buying base and the sophistication of that buying base.

So, it’s really important to think through the use cases here because the buying base for these types of businesses is actually vast and buried.

1./ Buyers who already own a portfolio of online businesses

Blake: We’ve met people who own portfolios of e-com businesses who want to buy an agency so that they can have their own in-house paid media capability. That’s use case number one.

2./ Agencies looking to extend their service offering

Blake: Use case number two is you own a bunch of different agencies doing different things. Now you have a gap where your existing client base needs a service. And so, you go and buy an SEO agency because you’ve currently got a paid media agency and a creative agency, but you don’t have an SEO agency. Now you can onsell those services to the client base within your other agencies.

That scenario is very common. It’s a use case that has existed for decades upon decades but is certainly a valid one for buying a business of this type.

3./ Buyers who want to own a digital agency

Blake: The other type of buyer is someone who believes in the value of owning a client base but doesn’t own an agency. They don’t own a network of other businesses but quite simply like the idea of acquiring something that is more likely to go from 10 to 100 than zero to 10.

This scenario is no different to the other use cases that you and I discuss all the time. Buyers are looking to buy a cash flow generating business, which is:

- Strong,

- Sustainable,

- Has a client base that they trust,

- Where the buying base will continue on for a long time to come.

They can just come in and ramp it up.

Matt: Great. Now, on the Flippa platform, you can buy digital agencies, YouTube channels, and social media accounts. These can all be added to your digital assets.

The most popular web assets in Flippa for 2024

Matt: Thinking about all these different assets, the deals you’ve seen, and the data you’ve got access to, what are the most popular web assets on Flippa in 2024? There’s been some changes out there, but where’s the market at right now?

Content websites are still the most sought-after assets

Blake: As you’ll see in the above screenshot, there’s a huge demand for assets. Generally speaking, when you go into the specifics, it’s still the likely types of assets.

Interestingly enough, while blogs, blog-based businesses, and AdSense-supported blogs are still on the top of the tree, it’s clearly a very long tail.

You’ll see substantial demand for SaaS businesses on the platform, with 40,000 unique searches. You can also see the beginning of a trend towards investors looking for AI-based businesses. There are 22,500 buyers looking for AI-related businesses.

But we’re also seeing industries evolve as new technologies come to market. The way in which investors think about acquiring tends to follow those macroeconomic trends as well. And so, I think it’s really interesting to look at this search data because it shows that most investors are quite conservative. They’re looking for those boring, consistent, repeatable businesses.

And then there’s a different cohort of buyers who are looking for something a bit more. They’re looking for new-age, state-of-the-art, new tech orientated, which is clearly evidenced by the AI search volume.

Matt: This data here is literally the raw data that people search for on the Flippa platform. This is buyer-generated data.

Blake: That’s correct.

Matt: All the niches are broken down. Traditional niches like travel and pets are still really popular. Nothing’s really changed there. And Blogs and Adsense are still number one. Even though you have Content there at the very end, that must be a separate search function on Flippa because blogs are the number one search asset.

Passion-based niches are still in demand

Blake: This is our search data by industry. The bigger box clearly indicates a greater search volume.

So, you can see there are searches for pets, beauty, fashion, jewellery, etc. These are really interesting products as a search or category. Then we also have searches for drinks, gambling, books, cooking, recipes, gardening, and web development.

Web development and social media could equally be agency-based searches. Sales and marketing as a category could also be agency-based searches, albeit they’re looking for assets within the category of sales and marketing. So, I found this data really interesting to look at.

Matt: This is great information on the main industries and niches with the most transaction activity on the Flippa platform. We’re seeing it right here in the search volume, and this is a very big data set. This is where the money (volume) is at.

The productivity search is a surprise.

Blake: I guess it comes down to the shifting face of work, the way we work and the continual evolution of technology and advice. It’s designed for those people who are looking to be more productive in their work day to get the most out of the hours that they’re working, and to create a work-life balance.

So, I think productivity is quite a broad term, but I thought it was very interesting to see the great density of that search.

Matt: Also, seeing those older niches from when we first started online, such as dating, golf, and photography. These terms are quite small now.

I noticed that e-commerce and Amazon FBA have dropped off quite a bit now, and it’s still content sites for 2024. This is what we want to hear in terms of the number one asset people are still searching for.

How the recent Google Updates have affected the deal flow of websites

Matt: When it comes to the recent Google Content Updates (HCU), what have you seen there? We can see from this data that it’s not slowing down, and there’s demand for good-quality content sites. However, with the Google updates, quite a few sites have been affected. From a buyer and seller perspective, what are you seeing there?

Blake: Well, the demand hasn’t slowed down, but transaction volume has. That means buyers are looking to get good deals, but sellers are refusing. They say, “We’ll stick with it because I believe my site is high quality, traffic is attainable, and I can bring it back to the levels it once was.”

So, there’s a bit of a stalemate between the selling and buying communities regarding how value is determined. Rather than taking a trailing six or a trailing 12, a buyer is taking a trailing three and then analysing it. They’re taking the trailing three because they believe it’s evidence of the asset’s current performance.

Should I buy a content website that’s been hit by the Google updates?

Matt: I’ll just explain what this means for our beginners. A trailing three means the last three months’ profit. Whereas you would normally look at the average over the last 6-12 months.

This is good advice if you’re looking at buying websites. Take the last three months because this would be more accurate with the recent Google updates. That’s a really good point for people to work off.

Blake: Well, it would depend on the site. Let’s just say a site performed terribly 9-12 months ago. If you take the trailing three, then, of course, the average is going to be far higher than the trailing 12.

On the flip side, if you’re looking at an asset that was impacted by Google; taking the trailing three will actually be the asset’s worst-performing months.

So, it’s a really interesting way to think about how you can negotiate. But I think you need to be smart about understanding what it actually represents.

Matt: When we’re looking at opportunities, because the update’s been pretty harsh on some content sites out there, the good news is that high-quality assets really stand out. So, you could argue it’s a great time to buy content sites because this is the ultimate test, and if they’ve come through this, then the quality of the website should do well.

The update has well and truly been rolled out over the last six months, so that is an aspect for buyers. The smart buyers know there are some really good opportunities out there at the moment. Maybe it’s a matter of fishing and finding out who’s negotiable. So, there is that argument as well at the moment.

Where to find opportunities if your site’s been hit by the Google update

Blake: The interesting thing is you don’t quite know where the world is going. It could be that many of these sites will recover really well? There are a lot of good content operators who know how to read the room and quickly evolve. They are nimble enough to recover quickly.

And sometimes, despite a traffic decrease, you become smarter about optimising the site for revenue. The rudimentary view of that is that if you used to be doing 100,000 page views and you’re now only doing 75,000, well that’s a 25% decrease in your page views. So, how do you find an extra 25% in revenue per page view? That’s a function of diversifying to other channels, adding things like affiliate programs on top of AdSense and other sources.

I can totally empathise right now with business owners and the sellers of these businesses. Ultimately, many of them are saying, “Well, hang on. If they don’t want to give me what I believe it’s worth and what I know I can deliver from it, regardless of whether it might’ve dropped 10 or 25%, I’m just not going to sell.”

So, the buyers are discrediting the seller’s capability, and the seller therefore doesn’t want to actually work with the buyer. There’s a softly, softly approach that each party needs to take to ensure that deals can still get done.

Are you looking to buy a larger website? Here are 2 great ways to start your search on the Flippa platform

Matt: Flippa now offers a premium buyer service where you can work with brokers. What does that mean? I imagine this would be a fantastic time for people to engage in this type of service, particular for larger website purchases.

Blake: So, a couple of points to mention here:

1./ Brokers who represent sellers on Flippa

Blake: The first thing is that around 25% of sites, stores, apps, etc, on Flippa are brokered. That means there is a middleman. And whilst that middleman is technically a sell-side representative, they’re obviously working with buyers to ensure they understand the asset and the motivations of the seller. They can also ensure the assets are validated, verified, and represented for the buyer.

So, that represents around 25% of all assets. These are typically higher-valued assets. So, you’re looking at a broker asset above $100,000 up to $10 million. The sites that are exiting at this value are brokered more often than not.

So, it’s really important that people understand that. They often think they’re talking to the seller. But you need to check the representation, and it will actually say “Brokered By…” That’s the key. Clearly, the broker is going to act as a conduit between the two parties.

2./ Flippa Premium Buyer Service

Blake: In addition to that, we now have a premium buyer service.

The premium buyer service is going to help you:

- Understand the platform,

- Set up your profile,

- Set up your first initial save searches so that you’re receiving alerts correctly for the assets and categories you want,

- Ultimately, they’ll go and hunt on your behalf for a little bit extra money (if you’re willing to do so).

Matt: Perfect. So, you can essentially get a buyer’s agent. They’re out there finding what you tell them you want as a buyer.

Blake: Yes, and we do that through buyer onboarding.

How to find the ideal website deal for your personal situation

…want to know how to find the ideal website purchase for you out of 400,000+ transactions on the Flippa platform? Here’s how using the Buyer Profile can help!

Blake: It’s really important that people go through their profiles and check whether they’ve got complete profiles.

Setting up the buyer profile in Flippa to find deals

Blake: A few things happen that most people don’t actually know, and then they wonder why they’re missing out on deals.

1./ Set up your buying preferences

Blake: The first thing we ask is for your preferences, and we’re not doing that to spy on you. We’re doing that to help you. For example:

- Category: you want Pets

- Business Model: you want e-commerce

- Size of business: you want between $50,000-$100,000

- How many deals: you want up to three, etc.

2./ Fill out your Bio

Blake: In addition to that, we’re going to ask you to create a bio, which is a little bit analogous to dating. Who are you and what do you want? The bio literally tells us about you.

There is another freeform text box that allows you to type in as much detail as you can about what you are looking to buy.

How the Buyer Profile matches buyers and sellers in the Flippa platform

Blake: Those two sections are critically important because that’s where data science takes over. The data science is reading your bio, reading that mandate, and programmatically matching you up. When it programmatically matches you up, it notifies you via email that a good match has been found.

It’s important to note that we do 400,000 of these matches each week. So if you’ve never received one of those, you’re not one of those 400,000 matches, it means you’re missing out on good deals.

Matt: This is awesome. And it’s great news for the sellers too, that there are a lot of transactions here (a huge amount of volume), and they’re going to be exposed to the ideal buyer for their site.

So, you guys now use data much more to drive this marketplace.

Blake: The numbers aren’t that complex. We’ve got 4,000 assets for sale right now. Out of the 4,000 assets per sale, each one only needs 100 matches, and suddenly, we’re talking about 400,000 matches. And we’ve got so many buyers on our platform that getting 100 matches for an asset is a piece of cake.

As new buyers come on each week, they show us evidence of their search intent, they create more bios, they fill out their mandates, and the matching just continues to stay on.

Matt: This is great news for both the buyers and sellers.

Is the age of a website important when buying an online asset?

Matt: We’ve been talking about how to find really good assets on Flippa and looking at the styles of website assets being searched for. But in your experience, Blake, when you want to buy a good-quality website, what age of website should people be looking at?

Blake: This is an interesting question that I can talk about for a while, so I’ll keep this short. If we agree that the vast majority of businesses that start actually end up failing. It’s somewhere along the lines that around 55% of businesses die within five years.

So, if we think about the fact that more than half die within the first five years, logically, the older the business, the more likely it is to continue to survive. And that’s how I try to get people to understand when they’re thinking of starting something.

When starting something from scratch, you’re actually playing some pretty bad odds. And when you think about buying something, you should improve your odds.

For me, age is kind of analogous to “location, location, location” in traditional real estate. Something that is five years old is highly likely to be a sure thing.

Why older sites are selling for higher multiples

Matt: Let’s say we’re looking at content sites, blogs, or AdSense sites; what are the better ones you’re seeing? What should our readers look for when they’re ready to buy a quality site?

Blake: The average site sold on Flippa is 4.5 years old. That gives you some sense of what people want to buy.

We also recently discovered that multiples go up for aged assets. So, the longer the asset has been around, the more premium price a buyer is willing to pay. People should understand why and how that works.

The short answer is it’s about predictability and repeatability. The buyer has greater confidence therefore, they’re willing to pay a premium. Again, analogous to “location, location, location”, the best locations will command a premium.

So my general view is that you should buy something with age unless you are actually looking for a startup, which some people are. That’s absolutely no problem.

You want to buy an established business with good quality cash flow to improve your chances of running predictably and repeatedly.

And you want to do that for its current cash flow, if not more. With this in mind, you should be looking for something that is in excess of two years old minimum.

Matt: Okay, two years minimum.

Blake: That would be the recommendation.

Matt: Okay, awesome. Because websites are a lot quicker than traditional brick-and-mortar businesses, anything a bit older than that is going to be better. But expect to pay a higher multiplier or premium for that asset.

Blake demonstrates how to find online businesses for sale on Flippa that are relevant to YOU

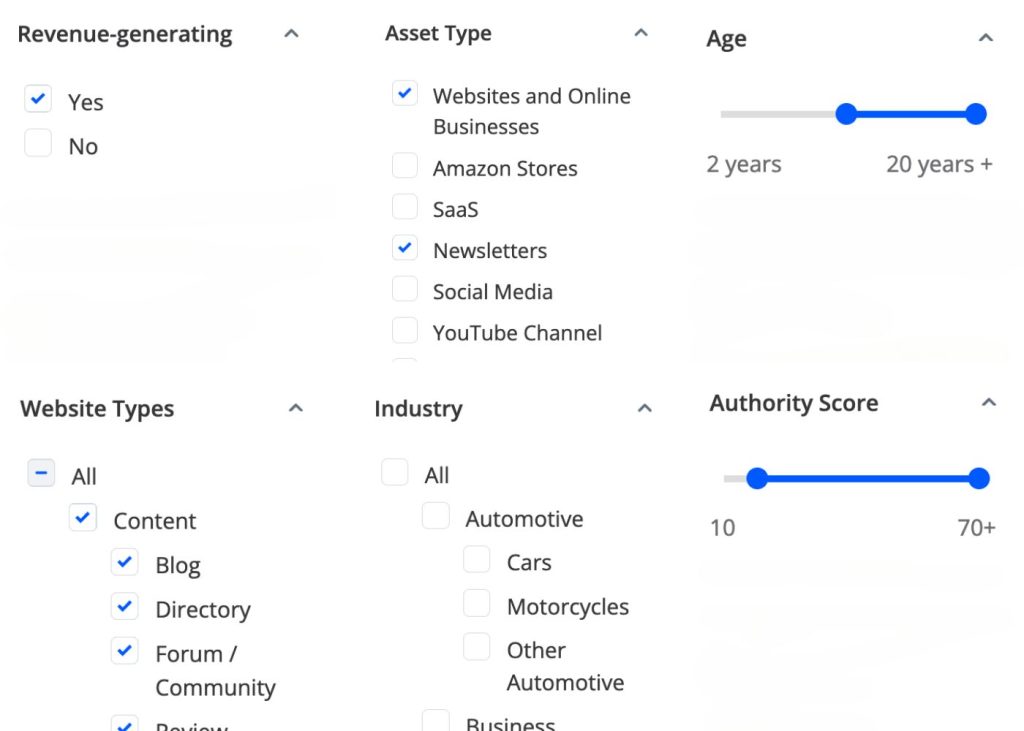

Blake: When I’m searching on Flippa.com I’m looking for 2 things:

- I’m looking exclusively at revenue-generating sites.

- And then I can scroll through the filters available on the left-hand side to help narrow my search.

There are plenty of filters to choose from, and here are some of them:

- Asset Type: for example, you can choose Website.

- Website Type: if you choose Website, you can then select the types of websites you want to search for, e.g. Content, blogs, eCommerce, etc.

- Media & Community Type: you can also search for other asset types such as Newsletters, Social Media, etc. When you do this, you can then drill down to select specific types of media and communities.

- Industry: you can search for specific industries, e.g. Cars, Business, Finance, Electronics, Food, etc.

- Age: this is really important. You can filter for, say 2 years or more.

- Authority Score: you might want to look at something that, in the eyes of which is essentially a proxy for Google score, it’s got an authority score of greater than, let’s say, 10.

How to narrow your search further with Flippa filters…

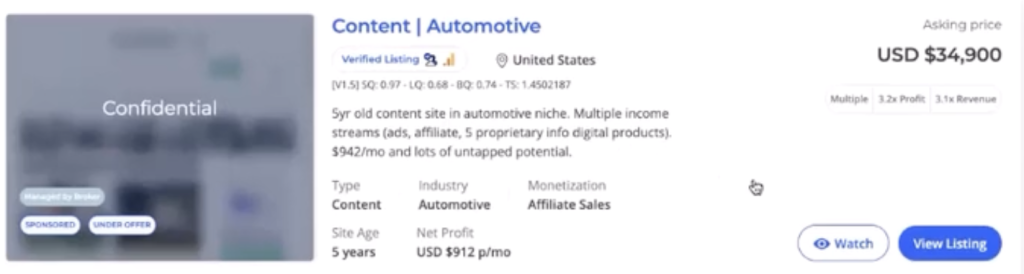

Blake: As a result of this search, I’m clearly looking at a cohort of sites. I went from 4,795 search results down to 776. And, of course, I can continue to filter these results more. But now, I’m looking at specific sites for my preferences. For example:

- An 8-year-old website asset.

- A 5-year-old marketplace.

- A 6-year-old SaaS business.

- A 6-year-old content site in the sports and outdoor niche.

All of a sudden, I now have a different view. I can then sort the search results by price, so I don’t have to look at sites priced at a million dollars at the top of my search results.

Say I filter my results even further to show me 2-year-old assets priced between $25,000 and $50,000. Now, I’ve got a far smaller cohort, and I’m down to 190 search results. I can see there is a 5-year-old content site that is $35,000. It’s 3.2x net profit, and it’s in the automotive niche. It has ad revenue, affiliate revenue, and some proprietary digital info products.

The point I want to make here is it’s not about the older you go, the more you have to spend. It’s that the older you go, the more predictable the revenue is.

Matt: Perfect. Whether you’re a beginner or advanced at buying and selling websites, I want you to understand this. The older you go, the more predictable the revenue is. This also means safety.

If you’re ready to make a serious purchase or looking to quit your job, you can follow the search function that Blake has shown on the Flippa platform.

Finding websites on the Flippa platform that could help you quit your job

Matt: I’ve personally noticed that whenever I search on the Flippa platform, there are regularly over 300 websites listed that are making $10,000 a month plus. So Flippa has obviously evolved a lot from the old days when there were a lot of smaller websites.

As you mentioned earlier, you guys are now selling a lot of “quit your job” style sites through to multimillion-dollar websites.

Blake: That’s right. We typically sell a few 7+ figure sites each month and regularly sell hundreds of 5-6 figure sites per month. The point is that we’re price agnostic. We want to be a marketplace and platform which is fit for all, while obviously having the technology and buyer universe under the hood that we have.

The reality is we’re the best possible representation for a seven-figure online business because we’ve got so many buyers, and we’ve got the technology that those buyers want to satisfy the deal flow needs. So it really is a solution that fits all online business owners, regardless of size and type.

Matt: It’s pretty amazing. Once you move past the starter sites, now you’re looking at hundreds of sites that for most people can help them quit their jobs, or could be a nice, viable alternative to real estate.

Real estate can be tricky for a lot of people these days. We find a lot of clients are maxing out. So, here’s another viable alternative. Not that I’m giving financial advice, but if you’ve got a bit more money to invest, hundreds of deals are on the Flippa platform. These are deals that have been verified and where you can get additional help to purchase through the premium buyer service.

Blake Hutchison shares his favourite content website deal on Flippa

See why a simple content website with evergreen content was recently sold on the Flippa platform for over $2.5 million dollars!

Matt: Blake, what’s been one of your favourite deals that you’ve seen in recent times?

Blake: Well, I really like the finance niche and content-based assets for obvious reasons. And I know you’re pretty similar in that regard, Matt.

I think it’s really interesting that someone can find something super specific that fills a strategic gap. And so, I’m really obsessed with that right now. We do have lots of institutional companies and strategic buyers looking for assets as a bolt-on to compliment their existing core business.

We had a recent example of an online business. It was a business called Day Trade Spy. And they essentially provided S&P 500 options trading courses. If you were looking to move into options trading, you would go to Day Trade Spy and they would have courses and learning materials.

Why the website was so valuable for the corporate buyer

Blake: Their method of revenue was through subscriptions as well as individual training packages. So, they would help you learn how to buy stock on the S&P 500, or you could learn how to do this yourself through their self-service subscriptions.

There was lots of great content on the site, which was clearly about the S&P 500, and this is clearly an evergreen niche. The S&P 500 is not going anywhere. It’s been around forever, and it will continue to be forever.

There was a strategic buyer called Eagle Publishing. I believe they were Florida-based. And the key value drivers (i.e. why do you want that particular asset?) for that strategic buyer were:

- It was a strategic gap in their portfolio.

- It had stable subscription revenue. So, they trusted the revenue business model.

- It was a fixed operational cost base. The courses generating revenue had been on the site for five to 10 years.

This was a very old, established site, and the way you trade the S&P 500 doesn’t actually change that much.

This business had a fixed operational cost base, and it actually led to a very high margin for the business. It was operating at a 94% gross margin.

There was a lot of interest in this business. We had nearly 4,000 buyers who inquired about this asset. At the end of the day, it sold for 4.6 times net profit and was a $2.5 million sale.

Why using a Flippa broker was so important to this deal…

Matt: Wow, the buyer would have been happy! And that shows the scale of it and the importance of getting to know your broker well. You need to be on the radar to find a purchase like that. You’re getting access to those sorts of deals once you get into that space.

Blake: It’s a really good point because clearly, we’re doing a lot under the hood to make sure we programmatically match. But that’s right. Our brokers do have entrenched relationships with buyers that they tap into to ensure the deals are done really efficiently.

Matt: This is so important, and Liz and I have seen this time and time again over the years. You need to develop relationships with good brokers.

And as you can see, you have the opportunity to connect with the Flippa brokers, get to know them, and fill out your buyer profile. As Blake explained, this is so important, especially if you’re a serious buyer.

They’re not spying on you, the data is anonymised anyway. But you need to be developing these relationships. The best money in business is made deals between real people. You don’t just want to be the anonymous data point, making anonymous bids. Make sure you are known to the brokers, particularly when you’re ready to step up into the six-figure plus and seven-figure range.

Here’s an invaluable tip from Flippa if you’re a serious buyer…

Blake: I’ll tell you something interesting, Matt. One thing I noticed when we ran some data a couple of weeks ago was there were 7,000 signed NDAs which had either been rejected or not reviewed. I was a little grumpy when I saw that!

I said, “These could be great buyers who want access to these listings.” But when we interrogated it, started to ask the brokers why, looked at why sellers may not have done it, and did the analysis, we realised 2 things:

- The vast majority of people who weren’t allowed to access had incomplete profiles.

- The vast majority of people who were allowed to access had complete profiles.

Matt: There you go!

Blake: The reality is, if your profile just says “Matt” and has nothing in the profile or mandate section, then why would you expect to have access to look at the proprietary, financial, and operational data attached to an asset?

Matt: Yes, so if you’re a serious buyer, even if you are just starting out, fill out your profile properly on the Flippa platform because you will be served with better deals. This is probably one of the biggest bits of advice Blake is giving to us. When you’re ready to step it up, this step is so important.

To add to that, if you want to get known and be on the radar of brokers, then get talking to Flippa brokers. They’re all awesome and know their stuff.

The more you network, the better the deals will become. We used to call it the deal flow. That’s what my personal mentors, and all the top buyers and sellers of businesses that I’ve ever known would do. They would personally go out of their way to get to know all the good brokers, no matter what size deals you’re doing.

Thank you so much for sharing your update with us, Blake. It’s been awesome finding out what Flippa’s been up to and the types of sites that are popular now. It’s been great seeing the new sorts of assets that people can buy and also learning some really cool tips on becoming a very effective buyer.

Blake: No worries at all, Matt. Thanks so much for having me.